Crucial Insights

- Huge financial institutions of today owe their size to a wave of bank mergers and acquisitions, with deal values soaring up to a staggering $66 billion in recent years.

- Capital One’s $35.3 billion takeover of Discover in May 2025 propelled it into the ranks of America’s top six banks by asset size.

- Over the last two decades, the number of FDIC-insured banks has plunged by more than 2,300, mostly shrinking during the past ten years due to ongoing consolidation.

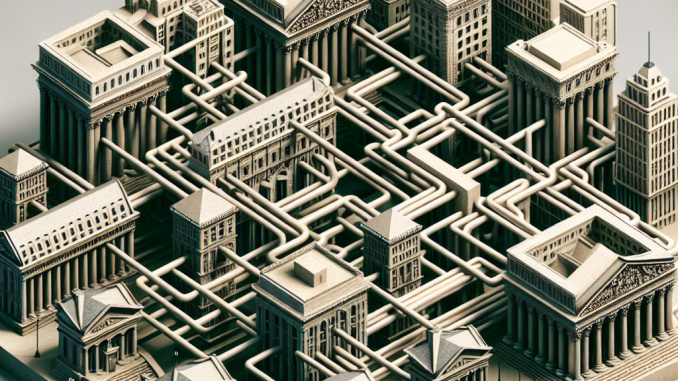

The banking landscape continually morphs through the fusion of financial institutions, forging colossal and competitive entities that dominate the sector. From Bank of America’s eye-watering $62 billion merger with NationsBank to Capital One’s recent multi-billion dollar absorption of Discover, these moves have redefined the power dynamics in American finance.

Understanding What Makes a Merger or Acquisition Tick

The Securities and Exchange Commission (SEC) labels a merger as the union of two or more firms forming a brand-new corporate organism. In the world of banking, such a fusion often hinges on shareholder nods and regulatory green lights because of the ripple effects on the economic fabric.

Acquisitions, on the other hand, involve a dominant bank gobbling up another, leading to significant shifts in user experience—be it through revamped account terms or fresh financial products.

Money Hack:

When your bank drops the merger bombshell, it’s a prime moment to reevaluate your financial toolkit. You might unearth sweeter interest rates or snazzier perks at rival banks while the dust settles.

Landmark Bank Mergers and Acquisitions That Shaped the U.S. Market

| Sept. 30, 1998 | Bank of America | NationsBank | $62 billion |

| July 1, 2004 | J.P. Morgan Chase | Bank One | $58 billion |

| Jan. 1, 2009 | Bank of America | Merrill Lynch | $50 billion |

| Oct. 27, 2003 | Bank of America | Fleet | $47 billion |

| May 18, 2025 | Capital One | Discover Bank | $35.3 billion |

| July 2, 2007 | Bank of New York | Mellon Financial Corp. | $18.4 billion |

| Oct. 3, 2008 | Wells Fargo | Wachovia Corp. | $15.1 billion |

| Aug. 28, 1995 | Chase Manhattan Corp. | Chemical Banking Corp. | $10 billion |

| Dec. 31, 2008 | PNC | National City | $6.1 billion |

| June 23, 2017 | CIBC | PrivateBancorp | $5 billion |

| July 29, 2016 | KeyCorp | First Niagara | $4.1 billion |

The colossal mergers listed above laid the foundations for today’s banking behemoths. Bank of America, for instance, solidified its colossal footprint through successive acquisitions, including the landmark NationsBank deal. These corporate blends have also been instrumental in expanding and diversifying the product landscape available to customers nationwide.

Recent Waves of Bank Consolidation (2019-2025)

- Capital One-Discover merger (2025): This blockbuster $35.3 billion transaction not only surged Capital One to the sixth-largest bank in the country by total assets but also crowned it the top credit card company nationwide.

- BMO Harris scooped up Bank of the West (2023): Valued at $16.3 billion, this deal beefed up BMO’s footprint across the United States—digital banking perks improved, but customers also felt the pinch as overlapping branches shuttered.

- BB&T and SunTrust joined forces (2019): The colossal $66 billion “merger of equals” gave birth to a Southeastern heavyweight, compelling clients to navigate overhauled banking services and relocated branches.

- M&T Bank absorbed People’s United (2022): The $8.3 billion deal reinforced M&T’s New England presence, broadening ATM access but potentially curtailing community branch networks.

- Huntington and TCF combined (2021): For $6 billion, this alliance fortified the bank’s Midwest stronghold, though account holders encountered changes in fees and product options.

Did you know? Over 5,000 banking institutions existed in the U.S. during the 1990s, but as of 2025, fewer than 4,000 remain FDIC-insured, reflecting intense industry consolidation and regulatory shifts over the decades.

The Capital One-Discover Union: A Defining Moment in Banking

When Capital One sealed its $35.3 billion acquisition of Discover Financial Services on May 18, 2025, it marked not just the biggest bank deal since the 2008 meltdown but a seismic shift in the industry’s credit card arena. This fusion made Capital One the sixth-largest American bank by assets and the largest credit card issuer across the nation.

What to Expect If You’re a Customer

- Augmented rewards programs by blending the best of both firms’ credit card perks

- Deeper digital banking functionalities rolled out for a smoother user experience

- Potential tweaks to existing accounts, with adjustments to terms and conditions that are worth scrutinizing

- Seamless integration of Discover’s payment networks meshed into Capital One’s broader banking platform

When Bank Failures Trigger Emergency Takeovers

The 2023 banking crisis underscored how swiftly financial institutions can flip ownership during turbulent times. Silicon Valley Bank, Signature Bank, and First Republic all collapsed within months, prompting urgent takeovers to safeguard depositors and maintain system stability.

Silicon Valley Bank → First Citizens: Tech-sector clients suddenly had to adapt to a more traditional regional banking environment, altering how their business finances were managed.

Signature Bank → Flagstar Bank: Account holders encountered modifications to access protocols and service structures as the transition took place.

How Mergers and Acquisitions Ripple Through Your Banking Life

- Account Reconfiguration: Prepare for new account numbers, routing details, and checks — the adjustment timeframe typically spans 12 to 18 months, during which old and new credentials may both be functional.

- Branch Streamlining: Overlapping branches often shutter post-merger, possibly changing your ability to handle in-person banking. Opt for institutions that prioritize personalized service if face-to-face attention is your preference.

- Fee Realignments: Bank mergers often synchronize fee schedules, leading to potential rises or drops based on whose policies take precedence. Staying alert to these shifts can save you unwanted surprises.